Next-Gen Logistics: Robotics & Automation Roadmap 2025–2030

By Rick Edwards | 06/05/2025 | Share:

Over the next 3–5 years (2025–2030), the logistics industry will undergo a paradigm shift driven by advanced robotics and automation. Key developments will center on autonomous mobile robots (AMRs), AI-driven inventory management, automated sorting and packing, drone and autonomous vehicle delivery, and robotic process automation (RPA) for supply-chain operations. Traditional manual forklifts, paper-based tracking, and integrated, structural conveyor systems will increasingly become legacy technologies.

While these innovations promise substantial gains in efficiency, accuracy, and safety, they also pose challenges around capital investment, workforce reskilling, cybersecurity, and regulatory compliance.

1. Introduction

The convergence of robotics, AI, and data analytics is redefining logistics. Recent disruptions—from pandemic-driven e-commerce surges to supply-chain fragility highlighted by extreme weather—have intensified the quest for resilient, flexible operations. This whitepaper provides a forward-looking analysis of the next 3–5 years in logistics automation, outlining technology roadmaps, legacy transitions, industry impacts, and implementation challenges.

2. Assumptions & Methodology

-

Time horizon: 2025–2030.

-

Market drivers: E-commerce growth, labor shortages, sustainability goals.

-

Technology adoption curve: Based on historical automation investment rates (3–5% annual growth through 2025) (McKinsey & Company) and current pilot programs in robotics.

-

Data sources: Industry reports (DHL, McKinsey), academic studies (arXiv), and recent news (Financial Times, Business Insider).

3. Current State of Logistics Automation

Warehouse robotics deployments have moved beyond proofs-of-concept into full-scale rollouts. Global logistics firms report pilot projects for AMRs, stationary robots, and AI-powered control towers accelerating toward production by 2025. However, overall investment in warehouse automation lags adjacent sectors, growing at only 3–5% annually, half the pace seen in retail and pharmaceuticals.

4. Key Technology Areas

4.1 Autonomous Mobile Robots (AMRs)

AMRs—robotic vehicles navigating warehouses without fixed guides—will proliferate, handling transport, picking assistance, and in-aisle replenishment. Major providers (e.g., Locus Robotics, Fetch) are scaling from hundreds to thousands of units per facility, delivering up to 30% efficiency gains in pilot programs. By 2028, AMRs are expected to be standard in mid-sized distribution centers, enabled by declining sensor costs and improved SLAM algorithms.

4.2 AI-Powered Inventory Management

AI systems will move beyond static barcode scans to continuous, predictive tracking. “Control-tower” platforms leveraging machine learning will fuse data from RFID, IoT sensors, and external feeds to forecast stockouts and optimize replenishment schedules in real time. Predictive maintenance models will also reduce downtime by up to 40% through anomaly detection in conveyors and robotic cells.

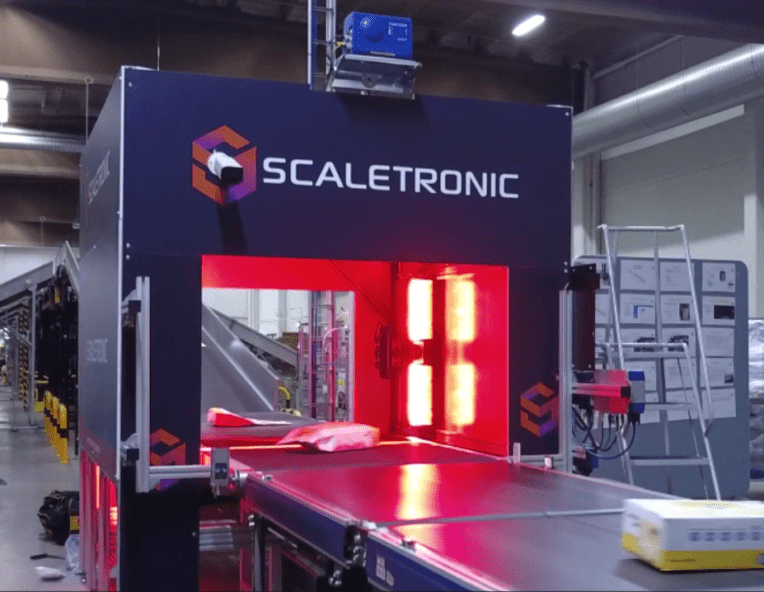

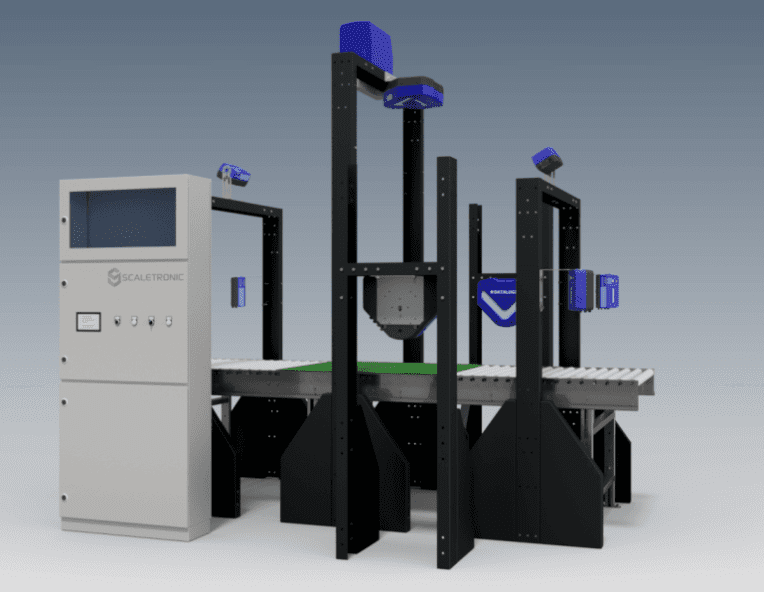

4.3 Automated Sorting & Packing

Next-generation modular sorters and packing cells will use computer vision and reinforcement learning to handle complex, variable-sized items. Academic benchmarks show deep-learning-driven picking systems achieving 95% accuracy in mixed-SKU environments, surpassing traditional machine-vision setups by 20%. Integration of flexible grippers and modular cells will drive wider adoption beyond high-volume e-commerce hubs.

4.4 Drone & Autonomous Vehicle Delivery

Outside the warehouse, drone delivery pilots aim to serve last-mile segments in under 30 minutes, especially in suburban and rural areas. Meanwhile, “level 4” autonomous freight trucks are entering commercial routes; Aurora’s deployments between Dallas and Houston showcase real-world operation under geofenced conditions. Combined, these solutions could reduce final-leg costs by up to 50% in specialized corridors.

4.5 Robotic Process Automation (RPA) in Supply Chain Management

RPA will automate back-office tasks—shipment scheduling, invoice reconciliation, and order tracking—freeing human teams to focus on exceptions and strategy. Surveys indicate 66% of logistics firms plan RPA deployments in the next two years, with error rates dropping by 70% and process times halving. RPA’s low-code nature accelerates rollout across ERP and TMS platforms.

5. Legacy Technologies & Transition Pathways

Technologies at risk of obsolescence include:

-

Manual forklifts & pallet jacks: Supplanted by AMRs and self-driving forklifts with safety cages.

-

Paper-based tracking: Replaced by RFID/IoT networks and AI dashboards.

-

Rigid conveyor systems: Outpaced by modular, reconfigurable sorter systems.

Legacy IT systems—often with 28% higher operational costs—hinder integration and data sharing, necessitating modernization to support cloud-native, API-driven architectures.

6. Industry & Workforce Impacts

-

Efficiency & productivity: Automation can bolster throughput by 20–30%, matching gains seen in early AMR deployments.

-

Cost reduction: Robotics-led warehouses report 25% lower unit costs, enabling reinvestment in AI and real-time visibility platforms.

-

Accuracy & visibility: End-to-end AI tracking drives inventory variances below 1%, down from typical 3–5% levels.

-

Safety & ergonomics: Cobots and exoskeletons reduce injury rates by handling heavy lifting and repetitive motions.

-

Job transformation: While routine roles decline, demand for robot supervisors, data analysts, and maintenance engineers grows; reskilling programs become critical.

7. Challenges & Considerations

-

Capital investment: Upfront costs for robots, sensors, and IT—often tens of millions per site—remain a barrier for mid-tier players.

-

Workforce retraining: Effective change management and training curricula are needed to transition staff to technical roles.

-

Cybersecurity risks: Increased connectivity expands attack surfaces; secure architectures and blockchain-backed audit trails will be essential.

-

Regulatory & safety: Autonomous vehicles operate under varied national frameworks; harmonized standards and certification processes must evolve in parallel.

8. Conclusion

The period from 2025 to 2030 will see robotics and automation become ubiquitous in logistics, reshaping operations from warehouse floors to delivery networks. Success hinges on integrated strategies that balance technology investments with people and process transformations. Firms that modernize legacy systems, embrace AI-driven insights, and prepare their workforce will capture significant competitive advantage in the automated logistics era.

References

-

“Warehouse Robotics and Automation,” DHL, 2025 DHL

-

“Logistics Trends 2025: AI Makes Its Way into Everyday Operations,” DHL, 2024 DHL Freight Connections

-

“Automation in Logistics: Big Opportunity, Bigger Uncertainty,” McKinsey & Company, 2019 McKinsey & Company

-

“Driverless Trucks Promise to Revolutionise Freight Transport,” Financial Times, Apr 2025 Financial Times

-

“Companies Seek AI Solutions to Supply Chain Fragility,” Financial Times, Apr 2025 Financial Times

-

Fernandez-Carames et al., “UAV and Blockchain-Based System for Inventory and Traceability,” arXiv, 2024 arXiv

-

“Robotic Process Automation in Supply Chain,” Logistics Viewpoints, 2024 Logistics Viewpoints

-

“Legacy Systems: How Outdated Tech Can Poison Your Business,” Forbes, 2024 Forbes

-

Panorama Consulting, “The Detrimental Impact of Legacy Systems on IT Modernization,” 2024 Panorama Consulting Group